October 2025 Market Commentary: Record Highs, Rate Cuts, and Resilient Growth

October Market Update: Records Keep Falling

October brought more good news for investors – the S&P 500 hit its 34th record high of the year, closing around 6,840. After a brief pause to catch its breath, the market rally continued, driven by strong corporate earnings, another Fed rate cut, and a trade truce between the U.S. and China.

U.S. Markets Extended Their Record Run

All four major indexes posted solid gains, with tech leading the way once again. NASDAQ jumped over 4%, while even the Dow managed a healthy 2.5% gain. Small-cap stocks also participated, suggesting the rally is broadening beyond just the mega-cap tech names.

The big news was NVIDIA reaching a mind-boggling $5 trillion market value—a testament to the continued AI investment boom driving much of the market’s strength.

October’s Winners:

- Dow Jones: +2.5%

- S&P 500: +2.3%

- NASDAQ: +4.3%

- Russell 2000: +1.5%

The Fed Cut Again

The Federal Reserve delivered its second rate cut of the year, dropping rates by another quarter-point to 3.75-4.00%. This shows the Fed is comfortable that inflation is under control enough to keep easing, even though it’s still above their 2% target.

Fed Chair Powell struck a measured tone, suggesting they’ll continue cutting gradually but won’t rush. This “just right” approach seemed to reassure investors.

Trade Tensions Eased

One of the month’s most important developments was a trade truce announced at the APEC summit in South Korea. The U.S. and China agreed to dial back some of the tensions that had been weighing on markets earlier in the year. While details were limited, just the fact that both sides are talking constructively was enough to boost investor confidence.

Global Markets Showed Strength

International markets had a solid month, with emerging markets actually outperforming developed markets. The MSCI Emerging Markets Index gained 1.9%, bringing year-to-date returns to an impressive 29.7%.

A weaker dollar and improving trade relations helped emerging markets, while developed international markets posted more modest gains of around 1.3% for the month.

Sector Performance Was Mixed

Despite the overall market gains, October’s sector performance was pretty mixed. Consumer Discretionary was the surprise winner, jumping 4.1% as investors bet on holiday spending. Energy also gained 0.6%, while Financials and Industrials posted modest gains.

But several sectors declined, including Information Technology (down 0.3% despite the strong market), Communication Services, Utilities, Materials, and Consumer Staples.

Sector Performance for October

| S&P 500 Sector | October 2025 | Year-to-Date |

| Consumer Discretionary | +4.08% | +7.21% |

| Energy | +0.64% | +3.04% |

| Industrials | +0.22% | +17.57% |

| Financials | +0.18% | +8.21% |

| Real Estate | +0.05% | +0.66% |

| Health Care | -0.09% | +4.69% |

| Communication Services | -0.31% | +25.85% |

| Information Technology | -0.32% | +29.30% |

| Consumer Staples | -0.48% | -0.58% |

| Utilities | -0.77% | +17.45% |

| Materials | -0.86% | +2.23% |

Source: S&P Dow Jones Indices

The year-to-date numbers tell the real story: Information Technology is up nearly 30%, and Communication Services is up almost 26%. Those two sectors are carrying a lot of the market’s gains.

The Economy Kept Growing

Third-quarter GDP estimates came in around 2-4%, with real-time forecasting models projecting growth near the upper end of that range. Consumer spending remained the primary driver, though it slowed from earlier quarters.

The big story continues to be AI-related business investment, which is growing at the fastest pace since the late-1990s tech boom. Companies are pouring money into AI infrastructure, software, and intellectual property.

Second-quarter GDP was also revised up to 3.8% from 3.3%, showing the economy had more momentum than initially thought. Part of that strong number came from a decrease in imports – since imports subtract from GDP in the calculation, when they fall it boosts the overall growth rate.

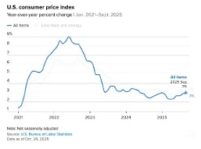

Inflation Stayed Stubborn But Improving

Core inflation held at 2.9% year-over-year, while headline inflation dropped to 2.7%. The Fed’s preferred measure (core PCE) tracked around 2.4% – still above their 2% target but moving in the right direction.

Housing costs remain the main problem, continuing to contribute significantly to overall price pressures. But other categories like auto insurance and airfares have started to normalize from earlier peaks.

Corporate Earnings Were Excellent

Third-quarter earnings season knocked it out of the park. With 64% of S&P 500 companies having reported by month-end, 83% beat earnings expectations and 79% beat revenue estimates. These beat rates exceeded historical averages and were the highest since Q2 2021.

Earnings grew about 10% year-over-year (10.7% excluding Energy), led by Information Technology, Financials, and Healthcare. Looking ahead, analysts are projecting 7.6% growth in Q4, followed by even stronger growth in early 2026.

The forward P/E ratio stands at 22.9, well above both 5-year and 10-year averages. While that’s expensive, the strong earnings fundamentals are supporting these elevated valuations – at least for now.

Consumer Confidence Kept Falling

Consumer confidence dropped for the third straight month to 94.6 – the lowest since April and well below last year’s 109.5. While people think current conditions are okay, they’re worried about the future. The Expectations Index fell to 71.5, staying below 80 for the ninth straight month – a level that historically signals recession risks.

People are particularly concerned about the job market. Interestingly, the percentage of consumers who think we’re already in a recession keeps rising, even though we’re not officially in one.

Holiday Spending Looks Weak

Consumers are planning to spend less this holiday season – about 4% less on gifts and 12% less on non-gift items compared to last year. When asked what’s driving their decisions, people cited promotions and getting the best value, showing they’re very price-sensitive right now.

Housing Market Stayed Soft

Despite mortgage rates dropping to around 6.2% – the lowest of 2025 – the housing market remained sluggish. Pending home sales fell 1.9% year-over-year, showing buyers are still cautious.

Home prices hit a median of $424,200, up 0.4% from last year. Homes are sitting on the market longer (63 days, up 5 days from last year), and more sellers are cutting prices.

Manufacturing Sector Shows Regional Differences

The manufacturing sector continued to struggle in October, though the picture varied significantly by region. Regional Federal Reserve surveys painted a story of persistent headwinds from elevated interest rates, policy uncertainty, and moderate demand.

The Richmond Fed’s manufacturing index improved notably to -4 in October from -17 in September, showing some sequential improvement while still remaining in contraction territory (anything below zero indicates contraction). The Dallas Fed’s Texas Manufacturing Outlook Survey showed more persistent weakness, with the general business activity index registering -8.7 in September, down from -1.8 in August. Production and new orders in the Texas region remained under pressure, reflecting the ongoing challenges facing manufacturers in energy-related and traditional manufacturing sectors

One bright spot: price pressures in manufacturing showed some moderation in October. Both prices paid for inputs and prices received for finished goods decelerated, suggesting that earlier tariff-related inflation may be easing. However, manufacturers still face challenges from supply chain adjustments and ongoing policy uncertainty around trade.

Gold Hit Historic Highs

One of the most remarkable stories of October was gold surpassing $4,000 per ounce for the first time in history. Central banks, particularly in China, Russia, and Turkey, have been loading up on gold, pushing its share of global reserves to about 18%.

Bottom Line

October showed that the market rally still has legs, even after such a strong year. The combination of solid economic growth, strong corporate earnings, another Fed rate cut, and easing trade tensions was enough to push stocks to new records.

The tech sector continues to dominate, with AI-related investments driving much of the market’s gains. Information Technology is up nearly 30% year-to-date, and Communication Services is up almost 26%. That concentration is both a strength and a potential vulnerability.

The economic picture is mixed but generally positive. GDP growth remains solid, corporate earnings are strong, and inflation is gradually declining. But consumer confidence keeps falling, people are planning to spend less this holiday season, and manufacturing remains weak.

Valuations are definitely stretched at a forward P/E of 22.9, but as long as earnings keep growing at double-digit rates, investors seem willing to pay up. The risk is that if earnings disappoint or economic growth slows more than expected, these elevated valuations could become hard to justify.

Looking at the year as a whole, 2025 has been exceptional for investors. The S&P 500 has posted 34 record closes. The key question heading into the final two months is whether this momentum can continue, or whether some profit-taking and volatility are due after such an impressive run.

Sources: bea.gov; bls.gov; dallasfed.org; richmondfed.org; nar.realtor; factset.com; msci.com; spglobal.com; nasdaq.com; wsj.com; conference-board.com