August 2025 Market Update: Small-Cap Surge, Global Gains, and Sector Shifts

August marked the fourth consecutive month of gains for U.S. stocks, though the momentum shifted in interesting ways. Small-cap stocks stole the show while big tech took a breather, and international markets outperformed the U.S.

U.S. Markets Keep the Streak Alive

All four major indexes posted gains again, but this month belonged to smaller companies. The Russell 2000 (small-cap stocks) surged 6.0% – by far the best performance of the major indexes. Meanwhile, the big names that had been leading all year cooled off a bit.

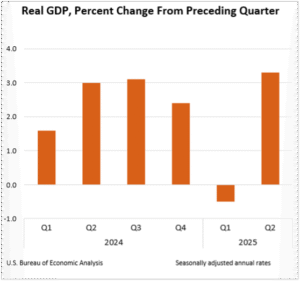

The economy gave investors reasons to be optimistic, with second-quarter GDP growth revised up to 3.3% from the earlier 3.0% estimate. Corporate earnings were also strong, with S&P 500 companies posting 11.9% year-over-year growth – the third straight quarter of double-digit gains.

August’s Winners:

- Dow Jones: +1.9%

- S&P 500: +1.2%

- NASDAQ: +1.4%

- Russell 2000: +6.0%

International Markets Outperformed

Nearly all developed markets posted gains, with most rising more than 4%. Asian markets did particularly well, with the Far East index up over 6%.

This outperformance suggests that while the U.S. economy is doing well, other parts of the world are catching up or finding their own sources of growth.

| Index Returns | August 2025 |

| MSCI EAFE | +4.06% |

| MSCI EUROPE | +3.24% |

| MSCI FAR EAST | +6.46% |

| MSCI G7 INDEX | +2.31% |

| MSCI NORTH AMERICA | +1.99% |

| MSCI PACIFIC | +5.72% |

| MSCI PACIFIC EX-JAPAN | +3.34% |

| MSCI WORLD | +2.49% |

| MSCI WORLD ex USA | +4.21% |

Source: MSCI. Past performance cannot guarantee future results

Sector Rotation

The sector rotation story continued in August, with leadership shifting around significantly. Communication Services was the big winner, jumping 5.5% after a quiet July. Some of the beaten-down sectors like Health Care and Consumer Staples continued their recovery.

But the real standout was how differently sectors performed. Technology, which had been the star all year, gained just 0.18% in August. Meanwhile, Industrials, which had a great July, actually declined 1.8%.

Sector Performance Comparison

| S&P 500

Sector |

July

2025 |

August 2025 |

| Information Technology | +6.51% | +0.18% |

| Energy | +2.75% | +1.89% |

| Health Care | -0.04% | +1.44% |

| Real Estate | +2.26% | +0.51% |

| Consumer Staples | -1.49% | +0.67% |

| Consumer Discretionary | +2.12% | +1.62% |

| Industrials | +3.47% | -1.77% |

| Financials | +1.33% | +1.57% |

| Materials | +0.59% | +2.11% |

| Communication Services | +0.56% | +5.51% |

| Utilities | +4.68% | +0.39% |

Source: FMR

The Economy Looked Stronger

GDP growth for the second quarter was revised up to 3.3%. The main driver was that we didn’t import as much as expected, which helped the calculation since imports subtract from GDP.

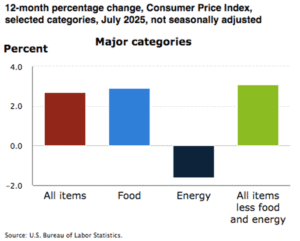

Inflation Stayed Stubborn

Inflation in July came in at 2.7% year-over-year – the same as June. While that’s much better than the levels of 2022, it’s still above the Fed’s 2% target. Core inflation (excluding food and energy) actually ticked up to 3.1%.

Housing costs were the main culprit, rising 0.2% for the month. Medical care also jumped 0.7%, while airline fares surged 4.0% – probably not great news for your vacation budget.

Corporate Earnings Stayed Strong

With 98% of S&P 500 companies having reported, 81% beat earnings expectations and 81% beat revenue expectations. That 11.9% earnings growth rate is impressive and shows companies are still finding ways to make money even with all the economic uncertainty.

However, looking ahead, nearly half the companies giving guidance for Q3 are projecting weaker earnings, which suggests some caution about the rest of the year.

People Got a Bit More Pessimistic

Consumer confidence dropped about 6% in August to 58.2, the first decline after several months of improvement. People are particularly worried about buying big-ticket items – confidence in purchasing durable goods hit its lowest level in a year.

The main concern? Rising prices. People reported feeling worse about their current financial situation mainly because of inflation worries.

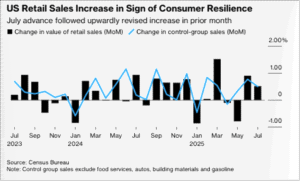

Retail Sales Stayed Solid

Retail sales jumped 0.5% in July and were up 3.9% from last year. Online sales continued to be strong, up 8.0% year-over-year, and restaurant spending rose 5.6% – showing people are still willing to go out to eat despite inflation concerns.

Housing Market Showed Mixed Signals

Pending home sales dropped 0.4% in July, which wasn’t great news. But they were still up 0.7% from last year, suggesting the market isn’t collapsing, just slowing down.

The regional differences were interesting – the West saw pending sales jump 3.7% for the month, while the Midwest dropped 4.0%. In the Northeast, pending home sales decreased 0.6% month-over-month and were down 0.6% year-over-year. This shows how different parts of the country are experiencing very different housing markets.

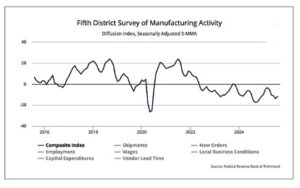

Manufacturing Was All Over the Map

Manufacturing data showed just how uneven the economic recovery is. Texas manufacturing had a great month, with production hitting its highest level in over three years. But manufacturing in the Richmond Fed region (covering parts of the Southeast) showed steep declines.

This kind of regional variation is pretty normal, but it shows that not every part of the country is experiencing the same economic conditions.

Oil Dropped, Gold Rose

Commodities told an interesting story in August. Oil prices fell $5.99 to $64.01 per barrel, an 8.6% drop that left prices about 12% lower for the year. But gold gained nearly 5%, benefiting from a weaker dollar and expectations that the Fed might start cutting rates.

Bottom Line

August showed us that even in a bull market, leadership can shift quickly. Small-cap stocks had their moment to shine while big tech took a breather. International markets outperformed the U.S., and sectors continued to rotate based on changing economic conditions.

The economic data was mostly positive – strong GDP growth, solid corporate earnings, and decent retail sales. But there are some warning signs too: consumer confidence is dropping, inflation is still sticky, and companies are getting more cautious about the second half of the year.

Four months of gains is a nice run, but August reminded us that markets don’t move in straight lines. The rotation from large-cap growth to small-cap stocks, and from U.S. back to international markets, shows that diversification continues to matter.

Looking ahead, the key questions are whether corporate earnings can keep growing at double-digit rates, whether inflation will finally start moving consistently toward the Fed’s 2% target, and whether consumers will keep spending despite their growing pessimism about the economy.

Sources: bea.gov; bls.gov; dallasfed.org; richmondfed.org; nar.realtor; factset.com; msci.com; fidelity.com; nasdaq.com; wsj.com; morningstar.com; goldprice.org