July Market Recap: U.S. Stocks Rise for Third Straight Month Amid Strong Earnings

July marked the third straight month of gains for U.S. stocks, with the S&P 500 hitting a new all-time high above 6,300. Corporate earnings continued to impress, inflation stayed relatively tame, and trade relations with China kept improving. Not everything was perfect, but the overall trend stayed positive.

U.S. Markets Keep Climbing

All four major indexes posted gains again, though the pace was a bit more measured than the previous two months. Tech continued to lead the way, while even the Dow managed a small gain.

The big story was corporate earnings – 80% of companies that reported beat expectations on both earnings and revenue. Many companies also raised their guidance for the rest of the year, showing confidence that business can stay strong even as economic growth slows down.

July’s Winners:

- Dow Jones: +0.1%

- S&P 500: +2.4%

- NASDAQ: +4.2%

- Russell 2000: +1.7%

Global Markets Were Mixed This Time

Unlike May and June when the whole world joined the party, July was more of a U.S. story. Developed international markets actually pulled back, with 29 out of 49 indexes declining.

But emerging markets bucked the trend in a big way – 39 out of 46 countries posted gains, with 20 of them rising more than 2%. This shows that while developed economies might be slowing down, emerging markets are still finding ways to grow.

Global Market Performance – July 2025

| Index | Returns |

| MSCI EAFE | -1.45% |

| MSCI EUROPE | -1.67% |

| MSCI FAR EAST | -0.70% |

| MSCI G7 INDEX | +1.63% |

| MSCI NORTH AMERICA | +2.12% |

| MSCI PACIFIC | -0.54% |

| MSCI PACIFIC EX-JAPAN | +1.20% |

| MSCI WORLD | +1.23% |

| MSCI WORLD ex USA | -1.27% |

Source: MSCI. Past performance cannot guarantee future results

Most Sectors Still Did Well

Nine out of eleven sectors posted gains, though the gains were smaller than June’s big moves. Information Technology led again with a solid 6.5% gain – not as hot as June’s 11.2%, but still impressive. Utilities surprised everyone with a 4.7% gain.

The only real laggard was Consumer Staples, which fell for the second month in a row. People are still buying groceries and household goods, but investors aren’t excited about these “boring” stocks right now.

Sector Performance Comparison

| S&P 500 Sector | June 2025 | July 2025 |

| Information Technology | +11.23% | +6.51% |

| Energy | +4.98% | +2.75% |

| Health Care | +3.08% | -0.04% |

| Real Estate | +1.57% | +2.26% |

| Consumer Staples | -0.91% | -1.49% |

| Consumer Discretionary | +4.76% | +2.12% |

| Industrials | +4.44% | +3.47% |

| Financials | +4.01% | +1.33% |

| Materials | +2.81% | +0.59% |

| Communication Services | +9.07% | +0.56% |

| Utilities | +0.78% | +4.68% |

Source: FMR

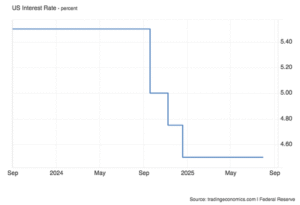

The Fed Stays Put But Shows Some Cracks

The Federal Reserve kept rates unchanged again at 4.25-4.50%, but for the first time since 1993, two Fed governors voted to cut rates immediately. Michelle Bowman and Chris Waller thought it was time to start lowering rates now rather than wait.

This disagreement shows the Fed is getting more divided about what to do next. With inflation still above their 2% target but some signs of economic softening, it’s a tough call.

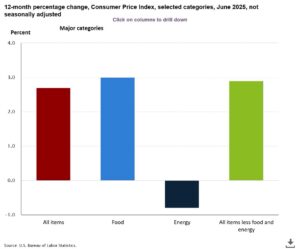

Inflation Ticked Back Up

Here’s the not-so-great news: inflation rose to 2.7% in June, up from 2.4% in May. Energy prices were the main culprit, with gas and electricity costs both rising. Core inflation (excluding food and energy) also edged up to 2.9%.

This uptick raises questions about whether the earlier progress on inflation has stalled. Both headline and core inflation are still above the Fed’s 2% target, which explains why they’re being cautious about cutting rates.

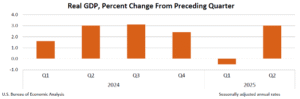

Economy Bounced Back in Q2

After shrinking in the first quarter, the economy grew at a solid 3.0% annual rate in Q2. The biggest factor was that we imported less stuff compared to Q1’s import surge, which helped the GDP calculation.

Consumer spending also increased, though the underlying demand (excluding government spending and trade) only grew 1.2% – suggesting the economy isn’t as strong as that 3% headline number might suggest.

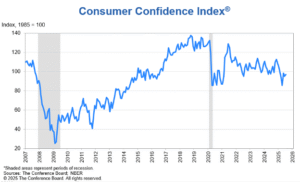

People Are Feeling Slightly Better

Consumer confidence improved a bit in July, though it’s still below last year’s levels. People are less pessimistic about the future, which is good, but they’re noticing it’s getting harder to find jobs – 18.9% of consumers said jobs were hard to get, up from 14.5% in January.

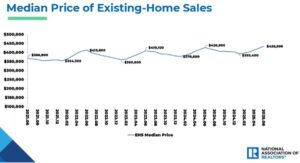

Housing Market Struggles Continue

Home sales dropped 2.7% in June to their lowest level since September 2024. High mortgage rates near 7% are clearly weighing on buyers. But here’s the weird part – home prices hit an all-time high for June at $435,300, up 2% from last year.

So we have fewer sales but higher prices, which shows there’s still not enough homes for sale to meet demand.

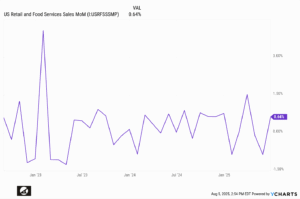

Consumers Bounced Back in June

After May’s spending pullback, retail sales rebounded 0.6% in June and were up 3.9% from last year. Online sales continued to be strong, up 4.5% year-over-year, and restaurant spending jumped 6.6%.

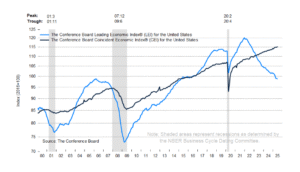

Economic Warning Signs Flash

The Leading Economic Index fell for the second straight month in June, dropping to its lowest level in a while. Several warning signs are flashing: consumer expectations are falling, manufacturing orders keep shrinking, and jobless claims are creeping higher.

The Conference Board isn’t calling for a recession yet, but they expect growth to slow to 1.6% this year from 2.8% last year.

Oil Prices Jumped

One bright spot for the energy sector was oil prices, which rose $6.48 to $69.33 per barrel – a solid 6.5% gain for the month. Summer driving season, OPEC production cuts, and reduced recession fears all helped push prices higher.

Bottom Line

July showed that the market rally still has legs, even if the pace is slowing down a bit. Corporate earnings remain strong, trade tensions keep easing, and while inflation ticked up, it’s still much better than the scary levels we saw in 2022.

The big question marks are whether the Fed will start cutting rates soon (they’re clearly divided on this) and whether the economic warning signs will turn into something more serious. For now, markets are choosing to focus on the positives – strong corporate profits and the possibility of rate cuts ahead.

The fact that emerging markets outperformed developed markets is also interesting. It suggests that while mature economies might be slowing down, there’s still growth to be found in other parts of the world.

Three months of gains is a nice run, but investors should keep an eye on those economic warning signs and be prepared for some bumps ahead.

Sources: bls.gov; bea.gov; factset.com; conference-board.org; msci.com; fidelity.com; nasdaq.com; wsj.com; morningstar.com; nar.realtor