September Market Update: The Fed Cuts Rates, and Markets Soar to the Best September in 15 Years

September Market Update: Best September in 15 Years

September is usually a tough month for stocks, but 2025 broke that pattern in a big way. The S&P 500 and NASDAQ posted their strongest September performance in 15 years, driven by the Fed’s first rate cut and continued strong corporate earnings.

U.S. Markets Extended Their Winning Streak

All four major indexes posted gains for the fifth consecutive month, with tech leading the charge once again. The Fed cutting rates for the first time since 2024 gave investors confidence that the central bank is ready to support the economy if needed.

GDP for the second quarter was revised up again – this time to 3.8%, partially thanks to incredibly strong software investment (up 198%!) as companies pour money into AI and digital transformation.

September’s Winners:

- Dow Jones: +1.9%

- S&P 500: +3.5%

- NASDAQ: +5.6%

- Russell 2000: +3.6%

The Fed Finally Cut Rates

The big news of the month was the Federal Reserve’s first rate cut of this cycle. After holding rates steady for months, they finally decided conditions were right to start easing. This doesn’t mean the economy is in trouble – it’s more about getting ahead of potential slowdowns and making sure inflation keeps moving toward their 2% target.

Global Markets Were Mixed

International markets showed mixed results this time. Developed markets did reasonably well, with most posting modest gains. But emerging markets were all over the place, depending on each country’s specific situation.

Europe gained nearly 2%, and North America (including the U.S.) was up 3.6%. But some Asian markets struggled, with the Pacific ex-Japan index actually declining 0.5%.

Global Market Performance – September 2025

| Index | Returns |

| MSCI EAFE | +1.64% |

| MSCI EUROPE | +1.93% |

| MSCI FAR EAST | +1.44% |

| MSCI G7 INDEX | +3.19% |

| MSCI NORTH AMERICA | +3.56% |

| MSCI PACIFIC | +0.94% |

| MSCI PACIFIC EX-JAPAN | -0.50% |

| MSCI WORLD | +3.09% |

| MSCI WORLD ex USA | +1.86% |

Source: MSCI.

Tech Led the Way Again

Seven out of eleven sectors posted gains, with Information Technology stealing the show with a 7.2% gain. Communication Services was also strong at 5.5%, benefiting from AI investments and digital advertising growth.

Utilities provided solid defensive gains at nearly 4%, while Consumer Staples and Materials were the laggards, declining -1.8% and -2.3% respectively.

Sector Performance for September

| S&P 500 Sector | September 2025 | Year-to-Date |

| Information Technology | +7.21% | +21.75% |

| Communication Services | +5.53% | +23.69% |

| Utilities | +3.97% | +15.13% |

| Consumer Discretionary | +3.12% | +4.74% |

| Industrials | +1.72% | +17.07% |

| Health Care | +1.62% | +1.20% |

| Financials | +0.04% | +11.49% |

| Energy | -0.52% | +4.27% |

| Real Estate | -0.14% | +3.47% |

| Consumer Staples | -1.82% | +2.04% |

| Materials | -2.31% | +7.73% |

Source: S&P Dow Jones Indices

The Economy Kept Growing

Second-quarter GDP was revised up once more to 3.8% – a really solid number. The standout stat was software investment, which absolutely exploded at a 198% annual rate. Companies are betting big on AI and digital transformation, reminiscent of the late-1990s tech boom.

Consumer spending stayed strong too, which is the most important driver of economic growth.

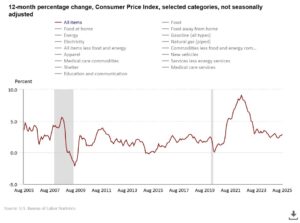

Inflation Ticked Higher

August inflation came in at 2.9% year-over-year, up from 2.7% in July. Food prices were the main culprit, jumping 0.5% for the month – the biggest gain since August 2022. Grocery prices rose 0.6%, with fruits and vegetables up 1.6%.

Core inflation (excluding food and energy) held steady at 3.1%, still above the Fed’s 2% target but heading in the right direction.

Corporate Earnings Stayed Strong

Companies continued to beat expectations, with 81% reporting better-than-expected earnings and 81% beating revenue forecasts. Earnings grew 11.8% year-over-year – the third straight quarter of double-digit growth.

Looking ahead, analysts are projecting 7.9% earnings growth for Q3, which would be solid though slower than recent quarters.

The only concern is that valuations are getting stretched – the forward P/E ratio of 22.5 is well above historical averages, suggesting investors are paying a premium for future growth.

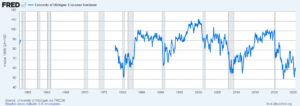

Consumer Confidence Dropped Again

Consumer sentiment fell for the second straight month to 55.1, down about 5% from August. People are worried about inflation, tariffs, and the job market. Confidence in buying big-ticket items hit its lowest level in a year.

Interestingly, people with significant stock holdings felt fine, while those with little or no stock exposure felt worse – showing how the market rally isn’t benefiting everyone equally.

Retail Sales Stayed Steady

Retail sales rose 0.5% in August and were up 3.9% from last year. Online sales continued their strong performance, up 8.0% year-over-year, while restaurant spending gained 5.6%.

The moderate pace suggests consumers are still spending but being more selective about where their money goes.

Manufacturing Still Uneven

Regional manufacturing surveys continued to show big differences across the country. Texas manufacturing stayed strong with healthy production and capacity utilization. But manufacturing in the Richmond Fed region (Southeast) remained under pressure from weaker orders and softer shipments.

This regional divergence shows that not every part of the country is experiencing the same economic conditions.

Bottom Line

September’s strong performance – the best in 15 years – showed that even with concerns about inflation and consumer sentiment, markets can rally when the Fed signals support and corporate earnings stay strong.

The rate cut was a big deal psychologically. It told investors that the Fed is watching out for the economy and willing to act if growth slows too much. Combined with solid GDP growth and strong corporate earnings, that was enough to keep the rally going for a fifth straight month.

But there are some warning signs worth watching. Consumer confidence keeps dropping, people are worried about affording big purchases, and inflation ticked back up in August. Valuations are also getting expensive, which means stocks are priced for perfection – any disappointment in earnings or economic growth could lead to a pullback.

The year-to-date performance has been impressive, especially for tech stocks (up nearly 22%) and Communication Services (up nearly 24%). But with five months of gains in a row, it wouldn’t be surprising to see some volatility in the months ahead.

The key question going forward is whether corporate earnings can keep growing at these strong rates, and whether the Fed’s rate cuts will help keep the economy expanding without reigniting inflation. For now, markets are betting yes on both counts.

Sources: bea.gov; bls.gov; dallasfed.org; richmondfed.org; nar.realtor; factset.com; msci.com; spglobal.com; nasdaq.com; wsj.com; sca.isr.umich.edu